- March 20, 2024

- WSM

- 0 Comments

- 1094 Views

- 0 Likes

- Marketing, Salesforce

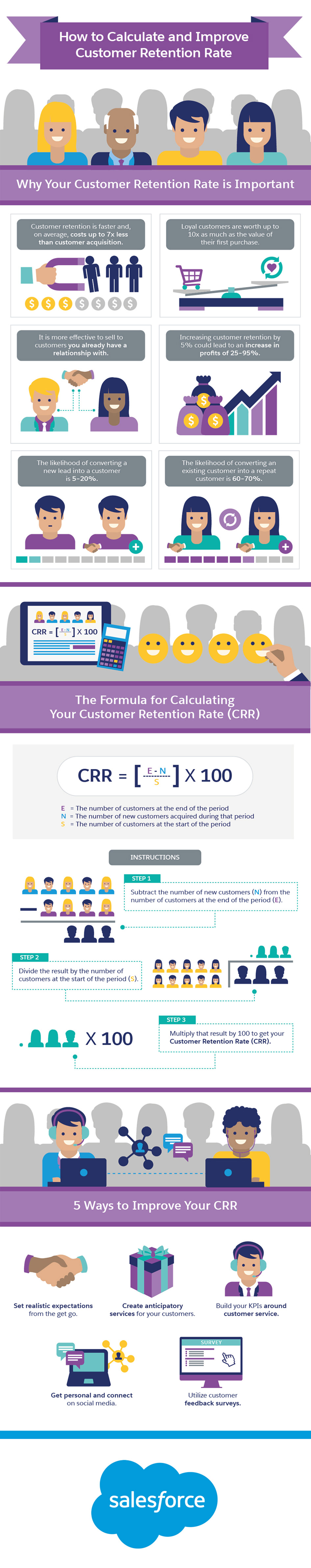

How to Calculate and Improve Customer Retention Rate

By Amanda DiSilvestro; When a company talks about analysing calculations, it can be intimidating. However, once you get a handle on the right metrics and what benchmarks customers expect, it turns into a simple process. Customer retention rate (CRR) is a great place to start: It’s easy to calculate. It’s also crucial to understand in order to help your company stay strong and grow. If you know why customers are sticking with you, you can better optimise your strategies for future customers. And, your CRR is a great number to throw out during a sales pitch.

What Is Customer Retention Rate and Why Does It Matter?

CRR is a figure that helps you understand how good your processes are in keeping customers happy and making them want to continue working with your company (retention). Customer retention begins with the very first impression and contact a person has with your company, and follows throughout the transaction and your company’s relationship with them. For example, a customer may begin this relationship when they “like” your Facebook page. That relationship won’t end unless they unlike your page, or other similar actions like not opening your email marketing campaigns, and removing themselves from your subscriber list.

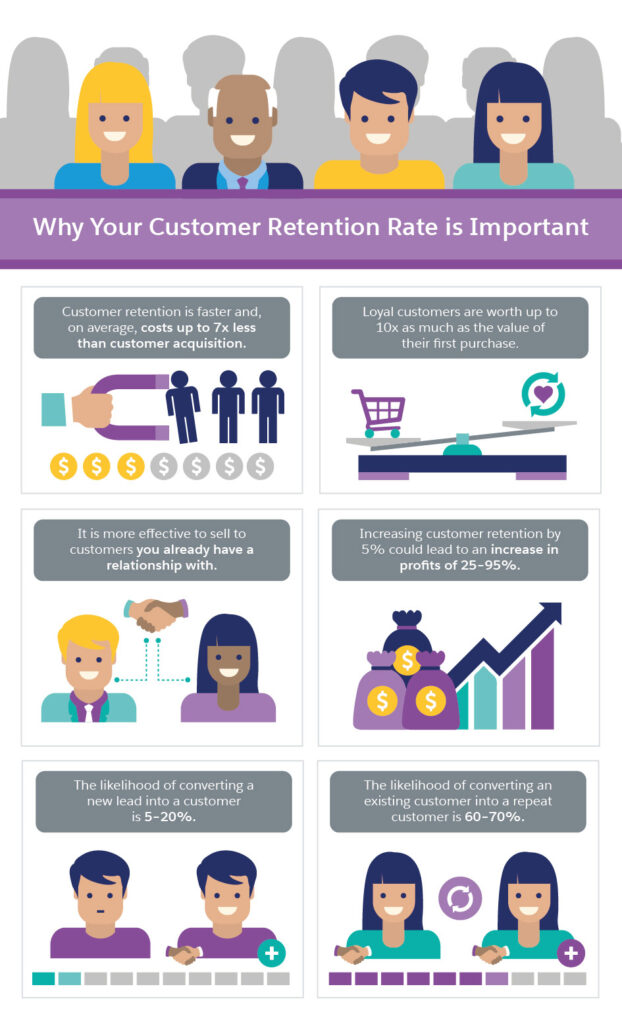

So why is calculating your customer retention rate so important? Quantifying your success helps you put initiatives in place to keep your company strong, but there are a few facts to keep in mind:

According to NG Data, customer retention is faster and, on average, costs up to seven times less than customer acquisition. This is because selling to customers who you already have a relationship with is more effective. You don’t have to attract, educate, and convert them from scratch.

Invesp reported that increasing customer retention by 5 percent could lead to an increase in profits of 25 to 95 percent.

According to a Huify article, the likelihood of converting an existing customer into a repeat customer is 60 to 70 percent, as opposed to 5 to 20 percent for a new lead.

Upselling to existing customers is usually more lucrative than whatever sale you would make on a new client.

According to Client Heartbeat, loyal customers are worth up to 10 times as much as their first purchase.

As you can see, customer retention is one of the best ways to grow the revenue of your business. The moral of the story: You want loyal customers. How, then, do you improve your customer retention rate? Before you worry about improving your number, let’s talk about how to calculate it.

How to Calculate Customer Retention Rate

THE GOAL

INFORMATION YOU’LL NEED

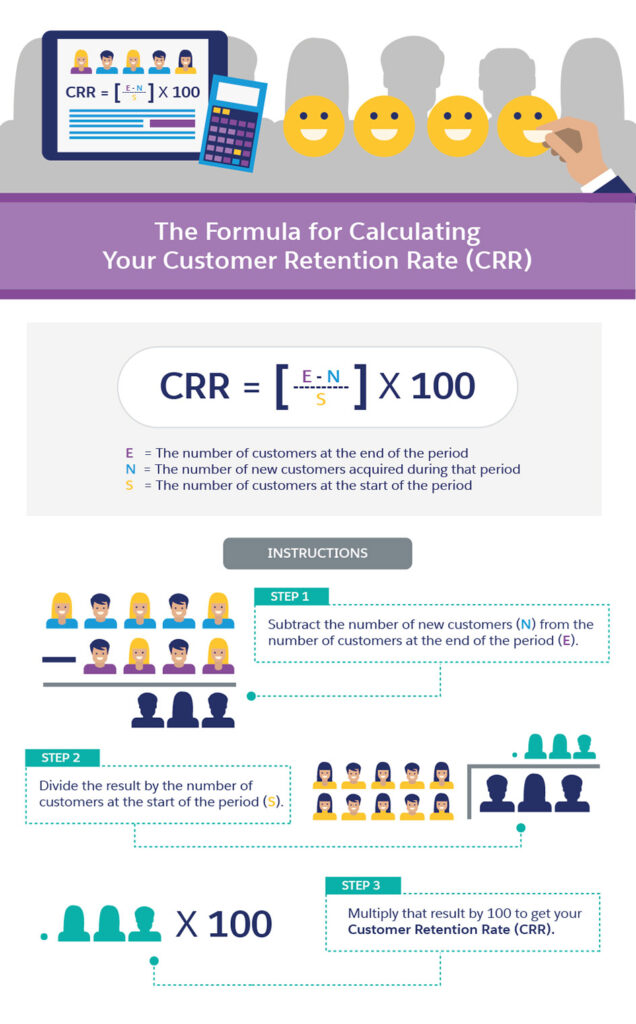

- The number of customers at the start of that period (S)

- The number of customers at the end of a period (E)

- The number of new customers acquired during that period (N)

THE FORMULA FOR CALCULATION

CRR = ((E-N)/S) X 100

AN EXAMPLE

Let’s say you had 107 customers at the start of the one-month period you’re tracking (S). During that period, you lost 8 customers, but you gained 21 (N) new customers. This means that at the end of the period, you had 107 of your original customers, plus 13 new customers, so you now have 120 customers (E) at the end of the period. Input those numbers into the formula:

CRR = ((120-21)/107) X 100

CRR = 92.5%

This means that your retention rate for that period was 92.5 percent.

BENCHMARKING CRR (WHAT YOU SHOULD AIM FOR)

5 Ways to Improve Your Customer Retention Rate

There are countless ways to help improve your retention rate, but if you really want to be successful, you have to be willing to truly evaluate your company, identify why some customers are leaving, and then put an actual customer retention plan in place. This plan will differ based on your company and the needs of your customers, but in almost all cases it will help to create a strategy and implement practices that can become a part of your routine. This makes improving your CRR specific to your business.

Here are some popular tips—applicable to all companies—to consider. These will set you on the right path.

1. SET REALISTIC EXPECTATIONS FROM THE GET-GO

You want to under-promise and over-deliver. This means that when you begin a relationship with a customer, make sure they know what they’re getting and what they can expect. You still need to capture a customer’s attention to close the sale, but don’t over-promise. Be as realistic as possible and then do your best to outperform what the customer is expecting. This helps create brand loyalty, and when customers feel they can trust you, it keeps them coming back. This also pushes your company to work with clear goals in mind and makes it easier to impress your customers.

Remember, too, that customers often recall negatives before positives, so avoid unpleasant experiences or unmet expectations. Even if you get it right nine times out of 10, that one mistake could be enough for a customer to leave.

2. CREATE ANTICIPATORY SERVICES FOR YOUR CUSTOMERS

Have a system in place so you can let your customers know of an upcoming payment, event, or problem before it happens. This helps establish trust: Customers will know you’re on top of your business. By keeping them in the loop, they’re less likely to get any late charges or surprises. The most common way to do this for most companies is to alert a customer when an invoice is due, but there are other ways your company can get creative with anticipatory strategies.

3. BUILD YOUR KEEP PERFORMANCE INDICATORS (KPIS) AROUND CUSTOMER SERVICE

4. GET PERSONAL AND CONNECT ON SOCIAL MEDIA

5. UTILISE CUSTOMER FEEDBACK SURVEYS

Who Needs to Implement Customer Retention?

Resources: CUSTOMER RETENTION RATE

Leave a Comment